The "2023 China Internet Insurance Consumer Insight Report" shows that the old-age anxiety is "younger".

With the economic transformation, demographic changes and cutting-edge technology development in China, the insurance industry in China is standing in a new historical position. Under the new situation, how can Internet insurance seize the opportunity of the times and take advantage of the situation? Answers from consumers will lead the continuous innovation of insurance products and services and provide new potential for the high-quality transformation and development of the insurance industry.

On April 23rd, 2024, Yuanbao Group (hereinafter referred to as "Yuanbao") and China Insurance and Pension Research Center of Tsinghua University Wudaokou Finance College (hereinafter referred to as "Tsinghua Wudaokou Insurance Center") jointly released the Consumer Insight Report of Internet Insurance in China in 2023 (hereinafter referred to as "Report"). Based on the macro-economic background, the Report explains the current consumption characteristics and future trends of Internet insurance from four dimensions: consumer behavior insight, portrait analysis of celebrities and potential products users, observation of consumption hotspots and judgment of industry trends, and outlines the opportunities of Internet insurance and insurance industry at present and even in the next decade.

This is the China Internet Insurance Consumer Insight Report jointly released by Yuanbao and Tsinghua Wudaokou Insurance Center in the third year. In the past three years, the Report has gained the attention and praise of the industry, and provided suggestions and references from the consumer demand level to promote the high-quality development of the industry.

Zhou Yanli, former vice chairman of China Insurance Regulatory Commission, said in the preface of the Report that 2024 is the 75th anniversary of the founding of New China, and a crucial year for implementing the Party’s 20th strategic plan and realizing the 14th Five-Year Plan. With the economic transformation, demographic changes and the development of cutting-edge technology in China, the insurance industry in China is standing in a new historical position. Facing the new bureau and new machine of the insurance industry in the future, Internet insurance should stand at the forefront and meet the new round of industrial changes.

The insurance industry has steadily recovered, and the demand for health, pension and wealth management has increased.

In 2023, China’s sustained economic recovery led to an obvious recovery of the insurance industry. In 2023, the original insurance premium income was 5.12 trillion yuan, a year-on-year increase of 9.14%. The survey results of consumer insurance expenditure in the report also confirm this growth trend. The data shows that in 2023, insurance consumption will recover steadily, with half of consumers spending more than 8,000 yuan on annual premiums. In the future, over 60% of consumers will spend more than 8,000 yuan on premiums, and the scale of premiums is expected to further increase.

Talking about the internal motivation of the growth of the insurance market, Wei Chenyang, director of the China Insurance and Pension Research Center of Wudaokou Finance College in Tsinghua University, said that the key points are the increase in demand for security brought by economic growth, the increase in demand for pension and medical insurance brought about by the aging population and changes in family structure. "China’s insurance industry will continue to benefit from economic development and people’s growing awareness of risks and become an important force supporting economic stability and social security."

According to the Report, consumers’ awareness of health risk protection ranks first, among which critical illness insurance is the product with the highest holding rate in 2023, with 60% of the respondents holding it, and the "three highs" with high income, high education and high city level are the main groups. In the future, critical illness insurance will gradually sink to a wider group. In addition to critical illness insurance, the holding rate of health insurance products such as commercial medical insurance and Huimin insurance is also high, accounting for 44% and 30% respectively, and there is still much room for growth in the future.

In addition, the aging has put pressure on the social security system, and consumers’ anxiety about providing for the aged has driven the enthusiasm for buying commercial pension insurance and long-term care insurance. According to the Report, commercial endowment insurance ranks second among the types of insurance planned to be purchased in the future. At present, the main force of commercial endowment insurance purchase is still high-income middle-aged people; However, in the next 1-2 years, the proportion of young people aged 20-30 who plan to buy commercial old-age insurance is the highest, and the old-age anxiety is beginning to show a younger trend. The nursing needs of middle-aged and elderly people have increased significantly. At present, high-income middle-aged and elderly people prefer long-term care insurance, and it is expected that more middle-and high-income groups with third-line and below will choose to buy it in the future. The insurance industry should accelerate the exploration of the innovation of "aging-suitable" products and services, enrich the supply of products for the elderly, and improve the breadth and depth of protection for the elderly.

Affected by the downward trend of interest rates, the certainty guarantee advantage of long-term interest locking of insurance is highlighted, which has become the ballast stone of consumer wealth management, and the future savings insurance is favored. Among the newly signed insurance products in 2023, savings insurance ranked sixth; In the planned insurance purchase, the ranking of savings insurance rose to the fourth place, which has a large room for growth. At present, the "three high" people are the main buyers of savings insurance, and will expand to young people in well-off income and low-tier cities in the future. And the steady income is the most important factor for consumers to buy savings insurance.

Consumer demand is more diversified, and long tail demand needs to be tapped.

"Unmarried" and "having fewer children" make the family structure in China show a trend of miniaturization, and the pressure on families to resist all kinds of risks increases sharply. With different ages and income groups, the demand of resisting risks and seeking protection through insurance is becoming more diversified and personalized. Some insurance that used to be small in the public began to be favored by specific people.

In 2023, natural disasters occurred from time to time in some areas, which made consumers begin to pay attention to the function of family property insurance in alleviating post-disaster economic pressure. Family property insurance will rank third among the newly signed insurances planned by consumers in the next 1-2 years. With the gradual popularization of property risk awareness, the demand for family property insurance will also extend from second-tier cities to third-tier cities and below.

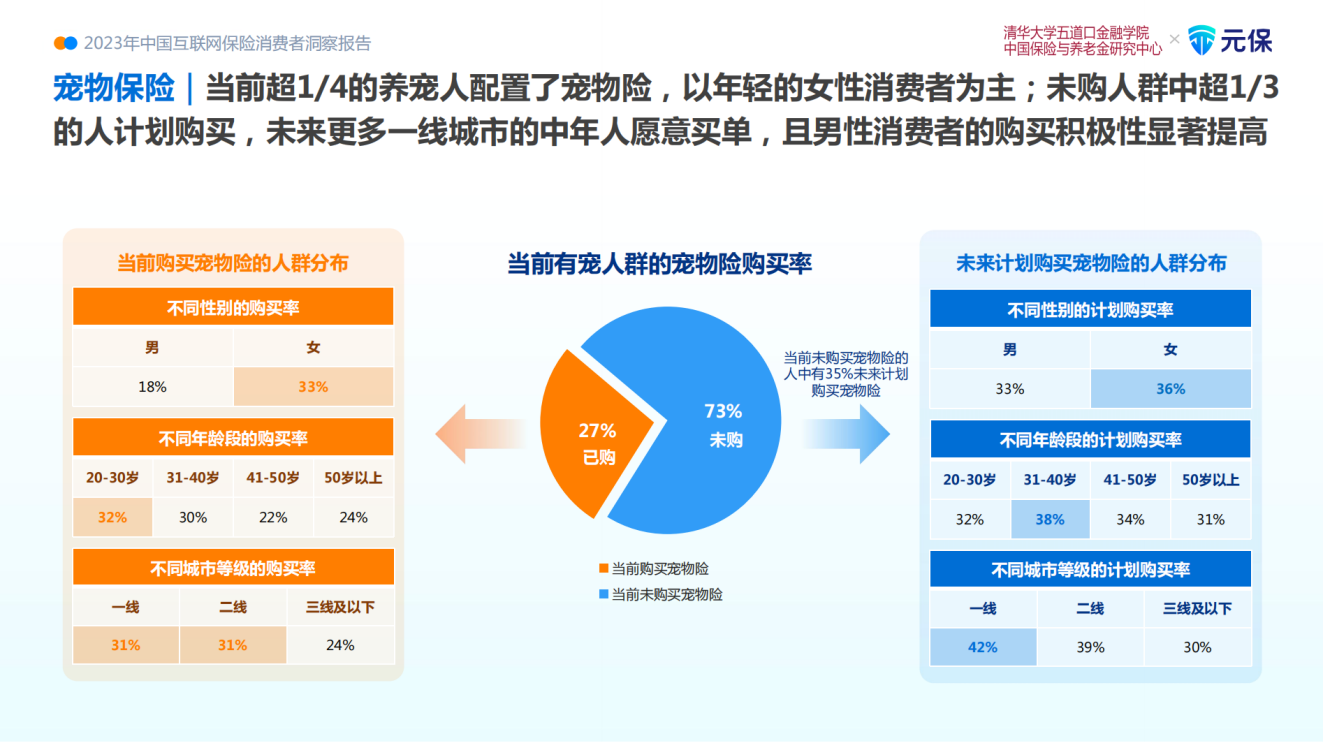

The importance of pets in people’s lives is increasing, and pet insurance is beginning to rise. According to the Report, at present, 27% pet owners are equipped with pet insurance, mainly young female consumers; 35% of the people who have not bought plan to buy, and more middle-aged people in first-tier cities will be willing to pay the bill in the future, and the purchasing enthusiasm of male consumers will be significantly improved. Insurance institutions accurately perceive and analyze the diversified needs of different customer groups, and launch targeted products+scene coverage, so as to tap the long tail demand and achieve diversified growth.

In addition to niche insurance, in the face of the same type of protection products, the demand differences of segmented customers are becoming more and more significant. When people aged 20-30 choose insurance, they mainly value "high cost performance"; People aged 31-40 value "wide product coverage"; People aged 51-60 value "low threshold for participation". The enlightenment for the insurance industry is that only by deeply understanding the differences of the core decision points of the insurance link and optimizing the differentiated positioning of products and services will the products achieve leap-forward development.

Intelligent claims are the strongest technology for consumers. AI big model landing practice will speed up.

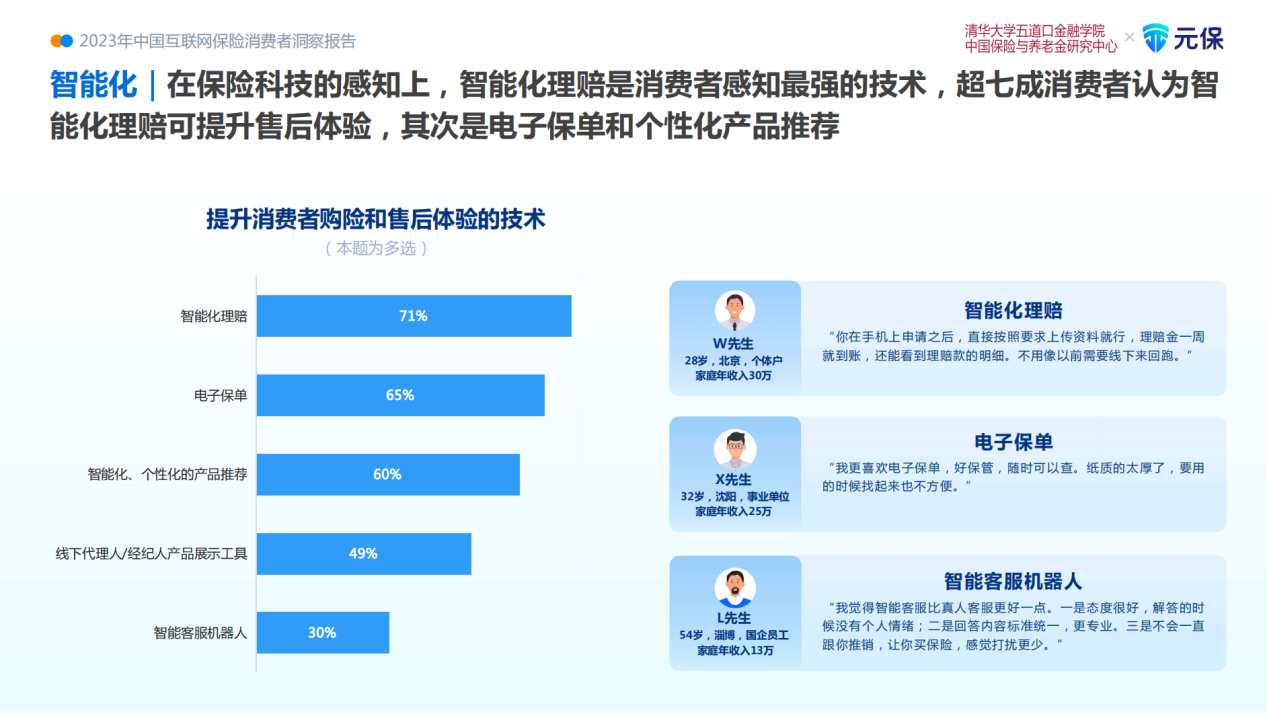

What factors do consumers value most when buying insurance? 46% of the respondents chose "the insurance company/platform has the strength" and "the claim is simple and the payment time is short". "Worried about the difficulty or rejection of claims" (50%) and "unable to understand the insurance clauses" (39%) are the core troubles of consumers in the past two years. Obviously, the claim link is very important for Internet insurance consumers to make insurance decisions, and intelligent claim settlement is alleviating this problem.

According to the Report, intelligent claim settlement is the technology with the strongest consumer perception, and 71% of the respondents believe that intelligent claim settlement has improved the after-sales experience. At present, more than 80% of consumers with online claims experience are satisfied with claims. With the in-depth application of big model technology, consumers’ troubles about claims are expected to be further eliminated.

Fang Rui, founder and CEO of Yuanbao Group, said that AI technology is kicking off a new round of scientific and technological revolution with amazing iterative speed. At present, the exploration of large-scale model technology in China insurance industry has achieved initial results, and there have been good application cases in customer service, marketing and claims settlement. Taking Yuanbao as an example, after the big model was introduced into the claims review process, the information collection time of a single medical document was reduced to 0.2 seconds, and the pass rate of online one-time review reached 97%, which promoted the speed of claims decision-making by 50%. In addition, Yuanbao combines a large-scale customer service robot, which has stronger understanding, expressive power and professionalism, and can solve complex professional problems in a more popular and understandable language, greatly improving the problem solving rate.

In 2024, AI big model will be accelerated in China insurance industry. In the future, the mode of "artificial+large model service" is expected to change the impression that insurance is difficult to understand, invest and compensate, enhance the public’s acceptance of insurance, and then enhance the popularity of insurance.

Online trend speeds up. Future online insurance purchase is expected to overtake offline.

In terms of exposure channels, in 2023, consumers are more inclined to learn about insurance brands through social media (58%), online channels of insurance brands (39%), short video apps (33%) and other online channels. Young people prefer social media and content platforms, while the elderly prefer short video apps.

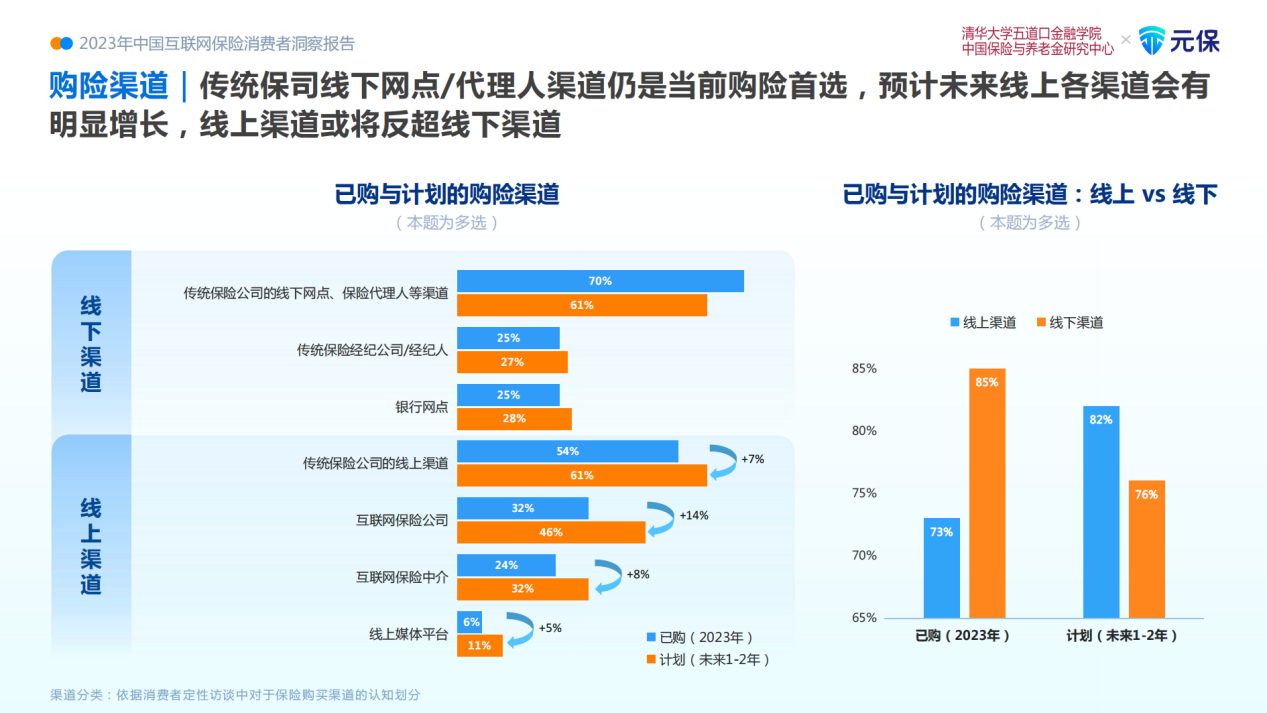

In terms of insurance purchase channels, the traditional offline outlets/agent channels (70%) are still the first choice for insurance purchase. However, compared with 2022, the online insurance purchase rate of consumers of all ages generally increased in 2023, and the offline insurance purchase rate decreased. The higher the income, the higher the education level and the higher the city level of consumers, the more inclined they are to buy insurance online. It is worth mentioning that the preference of the elderly for online has increased significantly. The online insurance purchase rate of elderly respondents aged 51 to 60 has increased from 63% in 2022 to 72% in 2023.

The top three reasons for consumers to purchase insurance online are "flexible payment" (52%), "convenient insurance" (49%) and "convenient self-inquiry and product selection" (46%). The higher the income and the higher the city level, the more attention is paid to the convenience, autonomy and less harassment of the insurance process; The lower the income and the lower the city level, the more attention is paid to the recommendation of relatives and friends. In the future, online channels will increase significantly, and 82% of the respondents plan to purchase insurance online, surpassing offline channels (76%).

However, about 8% of consumers who have bought insurance online may be "lost" in the future. 40% of the respondents are "worried about information security risks in online purchases"; 34% of the respondents are worried about "insufficient insurance notification"; 32% of the respondents are worried that "no one can be found and it is difficult to make claims".

Faced with consumers’ doubts about online insurance purchase, Internet insurance institutions should strengthen data security protection and privacy management, constantly optimize service processes, pay close attention to changes in regulatory policies and maintain compliance operations. With the joint efforts of supervision and industry, consumers’ concerns will be gradually dispelled, and the "online" experience will be continuously improved to achieve new breakthroughs.

Taking advantage of the situation, China insurance industry will usher in a new leap.

In 2023, China’s economy continued to pick up, with GDP exceeding 126 trillion yuan, up 5.2% over the previous year. The steady development of the macro economy has driven the insurance industry to achieve a significant recovery. In 2023, the original insurance premium income was 5.12 trillion yuan, a year-on-year increase of 9.14%. Under this background, under the guidance of supervision and the joint efforts of the industry, Internet insurance in China has also entered the "fast track" of high growth and high quality development.

Wei Chenyang said that China’s economic development is full of resilience, and the development prospect of the insurance industry is considerable. We are full of confidence in the transformation and upgrading of the insurance industry in China. In the future, Tsinghua Wudaokou, as a smart financial research and cooperation platform, will continuously establish connections with regulators, industry and academia, build an industry exchange platform, and promote the insurance industry to be stable and far-reaching and achieve high-quality development.

Fang Rui said that we are standing at a new historical intersection, and the demand preferences of insurance consumers are changing with each passing day. In the future, Yuanbao will continue to take consumers as the center, insist on the innovative development of Internet insurance driven by science and technology, keenly grasp the pulse of the times, and meet the needs of consumers with diversified, aging and intelligent products and services under the new situation of China’s economic upgrading and transformation, demographic changes and scientific and technological development, so as to promote the high-quality development of the Internet insurance industry and meet the new round of industrial innovation.