Professor Wei Wu.

Lingnan traditional Chinese medicine popular science forum

Medical Guidance/Professor Wei Wu, Director of Department of Internal Medicine, First Affiliated Hospital of Guangzhou University of Chinese Medicine

It sounds normal to get older, love cleanliness and can’t stand noise? However, if noise really makes middle-aged and elderly people feel flustered and chest tightness, it may be a signal from coronary heart disease! There are still many imperceptible signals in life, all of which are that the heart is "calling for &hellip", such as chest pain when nervous, palpitation when eating too much, need a high pillow when sleeping, and suddenly have difficulty breathing when lying down. …

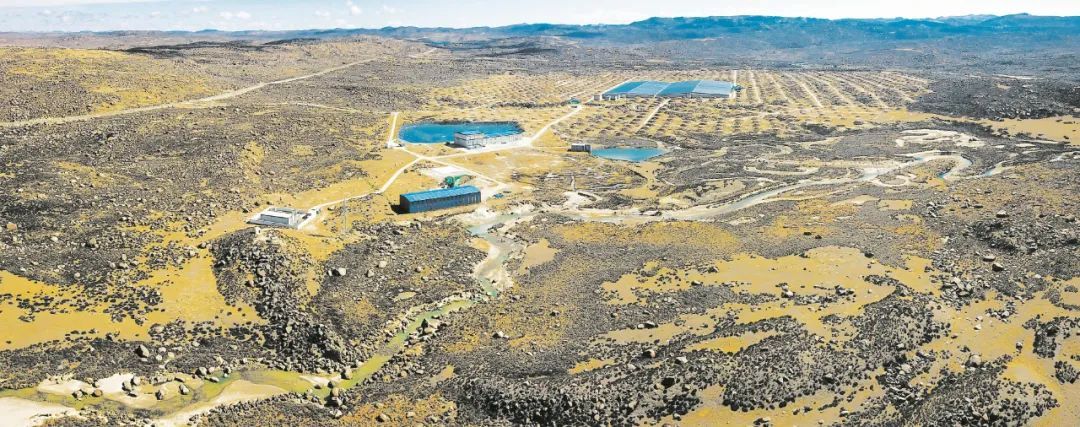

On July 29th, the ninth issue of Lingnan Chinese Medicine Popularization Forum was held in Sin Nui Hung’s former residence, where the traditional cultural charm was strong. Professor Wei Wu, the academic successor of Deng Tietao, a master of Chinese medicine, and the director of the Department of Internal Medicine of the First Affiliated Hospital of Guangzhou University of Chinese Medicine, shared his exclusive experience in preventing and treating coronary heart disease and daily aftercare with integrated traditional Chinese and western medicine.

Professor Wei Wu reminded that at present, patients with cardiovascular diseases will be more "difficult" when the temperature continues to be high, often in the extremely cold and hot climate. Everyone should take care of themselves.

Text, map/Guangzhou Daily All-Media Reporter Zhou Jieying Correspondent Hu Jiahong

What are the risk factors of coronary heart disease?

Coronary heart disease (coronary atherosclerotic heart disease) usually refers to the heart disease caused by coronary artery stenosis or obstruction, resulting in myocardial ischemia, hypoxia or necrosis, which may be clinically manifested as asymptomatic myocardial ischemia (occult coronary heart disease), angina pectoris, myocardial infarction, ischemic heart failure and even sudden death.

Wei Wu said that the process of atherosclerosis is very slow, and all types of coronary heart disease may have no symptoms in the early stage, so we should pay attention to early detection methods. In essence, arteriosclerosis is a kind of vascular aging. What people can do is to delay the aging process as much as possible and avoid all kinds of unhealthy life behaviors that lead to accelerated vascular aging. Therefore, Chinese medicine advocates health preservation, starting from adolescence.

So, what are the risk factors of coronary heart disease in medicine?

Wei Wu said that uncontrollable risk factors include age, sex (the prevalence rate of male patients is higher) and heredity, while controllable factors include hypertension, hyperlipidemia, smoking, diabetes, obesity, stress, unhealthy diet and lack of exercise. The most common factors can be summarized as "four highs and one smoking": hyperlipidemia (dyslipidemia), hypertension, hyperglycemia (diabetes), high weight (obesity) and smoking.

If you are related to any one or more of these factors, for example, you are a middle-aged man with high work pressure and smoking, and the data in the annual physical examination report are not ideal … … Then pay special attention to the signals sent by the heart.

What "signals" suggest coronary heart disease?

Occasionally, when you are tired, you are flustered and breathless during exercise. It may not be a thing, and many people will not care. But superimposed risk factors, the following details, you may want to pay attention to — —

1. When mental stress occurs, there is stuffy pain in the posterior sternum or precordial region, or constrictive pain, which radiates to the left shoulder and left upper arm for 3-5 minutes, and then relieves itself after rest.

2. Chest tightness, palpitation and shortness of breath occur during physical activity, and they will relieve themselves at rest.

3. Headache, toothache and epigastric pain related to sports.

4. Chest pain and palpitations occur when you are full, cold or watching thrillers.

5. When you sleep with a low pillow at night, you feel chest tightness and breathlessness, and you need a high pillow to feel comfortable; Sudden chest pain, palpitation and dyspnea while sleeping or lying flat during the day can be relieved only by sitting up or standing up immediately.

6. Palpitation, chest tightness, shortness of breath or chest pain occur when defecating hard or having a hard sex life.

7. Hearing the sound of gongs and drums or other noises around will cause palpitation and chest tightness.

8. Repeated irregular pulse, tachycardia or bradycardia for unknown reasons. Especially with dizziness and transient fainting.

Chest pain "dangerous moment" should not be careless

Wei Wu said that if physical strength drops suddenly within a period of time, it may be a symptom of chronic and stable coronary heart disease; The other situation is also relatively slow, which will be manifested as ischemic cardiomyopathy, heart failure and arrhythmia. You should go to the hospital for examination as soon as possible.

In particular, people with risk factors for coronary heart disease, if the symptoms of chest pain are not relieved for more than 15 minutes, are likely to have an acute infarction. They must call the emergency number for help and try not to drive or take a bus to the hospital. This kind of pain is generally accompanied by oppression, squeezing pain, congestion and urgency, which can radiate to fingertips and toes.

Some manual workers have developed tolerance and may not be sensitive to these pains, and the elderly, diabetics who are insensitive to peripheral nerves, etc. may also be insensitive to pain, which will amplify the danger. We must be aware of prevention and not be careless.

Correct exercise and diet intervention can prevent coronary heart disease

Exercise intervention

It is recommended to do 30 minutes of exercise every day for at least 5 days a week. Exercise intensity is controlled at: the maximum heart rate per minute =180- years, or the maximum heart rate does not exceed 60% of the normal heartbeat. The best exercise can achieve the effect that aerobic exercise perspires slightly and you don’t feel tired the next day.

Exercise suitable for middle-aged and elderly people to prevent diseases includes walking, jogging, slow cycling, playing Tai Ji Chuan, and doing Baduanjin.

If you are already a patient with coronary heart disease, you should pay attention to exercise: avoid emotional excitement before and after exercise; It is not advisable to have a full meal before exercise; Exercise should be gradual, and don’t suddenly engage in strenuous exercise; Carry first-aid drugs for coronary heart disease during exercise.

Dietary intervention

To prevent coronary heart disease, Chinese medicine pays attention to avoiding fat, sweet and thick taste, and suggests balanced+light+nutrition+total calorie control in diet, choosing a healthy diet containing a variety of fruits, vegetables, grains, low-fat or fat-free foods, beans, fish, poultry and lean meat, controlling salt intake and not drinking alcohol.

Reasonable diet can keep in mind the principle of "1234567": a bag of milk or soy milk every day; Two or two staple foods per meal, six or two per day; Three servings of high-protein food every day (1 liang lean meat, or half liang soybeans, or 2 liang tofu, or 1 egg, etc.). Four sentences: coarse and fine, not sweet or salty, three or four or five meals, seven or eight full; 500 grams (1 kg) of fresh vegetables and fruits every day, preferably green, red and yellow vegetables; The daily intake of salt should be 6 grams; Drink seven glasses of water (200ml a cup) every day.

Foods that can be eaten at will: grains, especially coarse grains; Beans, especially soybeans and their products; Vegetables, especially onions and garlic; Bacterial algae, such as mushrooms, fungus, kelp, laver, etc.; All kinds of melons, fruits and tea.

Foods that can be eaten properly: lean meat, including lean pork, beef and poultry (peeled); Fish, including most river fish and marine fish; Vegetable oil, including soybean oil, rapeseed oil, corn oil, sesame oil, etc. Milk, such as milk, goat milk, etc. Eggs, 2-3 per week, people with hypercholesterolemia should eat as little as possible.

Foods that you eat less or avoid: animal fats, such as lard, butter, sheep oil, chicken oil, cream, etc. Fat meat, including pigs, cattle and mutton; Brain, spinal cord, viscera; Egg yolk and roe; Mollusk and shellfish; Tobacco, wine, sugar, chocolate, etc.

Traditional Chinese medicine medicated diet nursed back to health: ginseng, codonopsis pilosula, astragalus, salvia miltiorrhiza, Polygonum multiflorum, hawthorn, Ophiopogon japonicus, motherwort, notoginseng, ganoderma lucidum, pueraria lobata, Taxilli and ginkgo leaves.