The Russian central bank suddenly announced: raise interest rates!

The Russian central bank suddenly zoomed in.

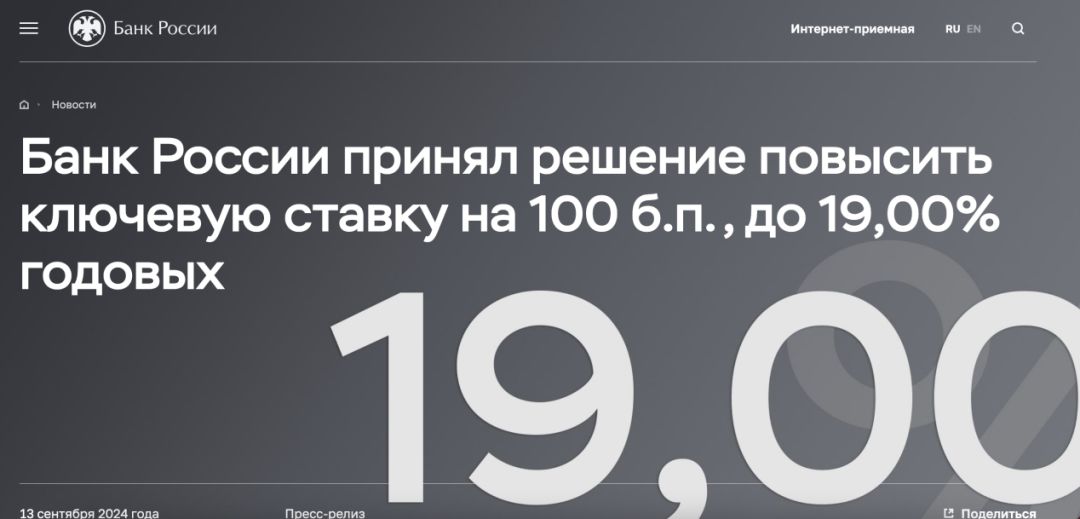

On September 13th, the Russian central bank announced that it would raise interest rates by 100 basis points and raise the benchmark interest rate to 19.00%. The market forecast is 18.00%. The Russian central bank said that inflation pressure is still relatively high, and it is necessary to further tighten monetary policy, and it is possible to raise key interest rates at the next meeting.

At present, the main reason for Russia’s unexpected interest rate hike is that domestic inflationary pressure continues to increase. In fact, in order to curb inflation, the Russian central bank has repeatedly raised interest rates violently, but the heat of social financing has not diminished. Analysts believe that this situation has greatly stimulated consumer demand and led to a further increase in inflation. Alexei ZaBotequim, deputy governor of the Russian Central Bank, said recently that the sensitivity of the Russian economy to the central bank’s key interest rate has decreased. In this case, it may be necessary to make greater adjustments to the key interest rate.

Russian President Vladimir Putin also pays special attention to reducing inflation. At a recent economic conference, he said that the Russian government and the central bank should pay attention to improving the effectiveness of coordinated actions in reducing inflation and systematically fighting inflation.

Announce a rate hike

On September 13th, the Russian central bank announced that it would raise the interest rate by 100 basis points and raise the benchmark interest rate to 19.00%, and the market forecast was 18.00%.

The Russian central bank said in a press release that inflationary pressure is still relatively high. By the end of 2024, the annual inflation rate may exceed the range of 6.5%-7.0% predicted in July. The growth of domestic demand still far exceeds the possibility of expanding the supply of goods and services. Monetary policy needs to be further tightened to restart deflation, reduce inflation expectations and ensure that inflation will return to the target level in 2025.

The Russian central bank admitted that it is possible to raise key interest rates at the next meeting. The Russian central bank predicts that, considering the current monetary policy, the inflation rate will drop to 4.0%-4.5% in 2025 and will be close to the target level of 4% in the future.

Nabiulina, governor of the Russian central bank, said that it is necessary to restore the inflation rate to the target of 4% next year and prepare to continue to tighten the policy.

The next board meeting of the Russian central bank is scheduled to be held on October 25, 2024, at which the key interest rate level will be considered.

According to the press release issued by the Russian central bank, in August, the current seasonally adjusted price rose at an annualized rate of 7.6%, and the core inflation index was calculated at an annualized rate of 7.7%, both lower than the average level in the second quarter of 2024, but higher than the average level in the first quarter of 2024. The estimated annual inflation rate as of September 9 was 9.0%, compared with 9.1% in August. This means that the inflationary pressure in Russia generally continues to be high and has not yet shown a downward trend.

The Russian central bank said that the labor market is still tense. The unemployment rate hit a record low again. There is still a serious shortage of labor resources, especially in manufacturing. Although wage growth has slowed down in recent months, it remains at a high level and continues to exceed productivity growth.

It is worth noting that the GDP data in the second quarter of 2024 and the operation indicators from July to August show that Russia’s economic growth has slowed down. The Russian central bank said that the main reason for this slowdown may not be the cooling of domestic demand, but the increase in supply-side restrictions and the decline in external demand. The current high inflationary pressure proves this point. The upward deviation between Russian economy and balanced growth trajectory is still very large.

The Russian central bank said that high market interest rates supported savings sentiment, but it has not yet fully curbed lending. Despite the slowdown in the retail sector, overall loan growth remains strong.

The Russian central bank said that in the medium term, the balance of inflation risk has obviously shifted to the risk that is conducive to inflation. The inflation risk related to the deterioration of foreign trade conditions has increased. The risk of persistent high inflation expectations and the deviation of the Russian economy from the balanced growth trajectory still exists.

After the Russian central bank announced a rate hike, the Russian stock market once fell, but then it continued to rebound. As of 21:30 Beijing time, the Russian MOEX index rose by more than 1%.

Why did you suddenly raise interest rates?

At present, the main reason for Russia’s unexpected interest rate hike is that domestic inflationary pressure continues to increase.

In fact, in order to curb inflation, the Russian central bank has repeatedly raised interest rates violently. At the meeting in July, the Russian central bank raised interest rates by 200 basis points.

However, the domestic financing fever in Russia is increasing instead of decreasing. By the end of June this year, the volume of commercial loans had increased by over 20% year-on-year, and unsecured consumer loans had increased by 3.5 trillion rubles.Analysts believe that this situation has greatly stimulated consumer demand and led to a further increase in inflation.

Alexei ZaBotequim, deputy governor of the Russian Central Bank, said recently that the key interest rate is the main and effective tool to affect inflation, but the Russian economy is less sensitive to the key interest rate of the central bank. In this case, it may be necessary to make greater adjustments to the key interest rate.

Recently, Russian President Vladimir Putin held a special economic meeting to discuss the main direction of national economic policy before 2030 and the implementation of national development goals. Putin said that economic indicators show that Russia’s industry, agriculture and service industries are generally improving, and enterprises and labor markets are running smoothly; Russia needs to strengthen the positive trend of the real economy and support enterprises to invest in developing new industries, creating jobs and training talents. On the whole, with the change of internal and external situation, Russia must make greater efforts to adjust its macroeconomic policies to overcome unfavorable factors.

During the economic symposium, Putin also paid special attention to reducing inflation. He said that the Russian government and the central bank should pay attention to improving the effectiveness of coordinated actions in reducing inflation, systematically fighting inflation, and increasing the supply of goods and services to meet domestic demand.

External pressure is also one of the reasons for the high inflation in Russia. According to the data of the General Administration of Customs of the Russian Federation, under the background of sanctions, Russian trade continues to shrink, with emphasis on imports. From January to June, Russia’s imports fell across the board, with imports from the European Union decreasing by 14.1% to US$ 34.9 billion and imports from the United States decreasing by 15.8% to US$ 6.9 billion. In the first half of 2021 before the conflict between Russia and Ukraine, Russia’s imports from the European Union and the United States were $44.8 billion and $8.4 billion respectively.

Some analysts pointed out that Russia is one of the countries with the highest sensitivity to the commodity cycle in the international market. The slowdown of global economic growth is accompanied by weak commodity prices. The reduction of international oil prices may adversely affect the value of the ruble, and lead to a decrease in Russian export income, which will put more pressure on economic activities.

Editor-in-Chief: Qin Hong

Text Editor: Cheng Pei

Author: China, a broker.

Source: Xinhua News Agency

Photo editor: Cao Liyuan