The heavy policy of the property market is released! Investment opportunities in the real estate sector are prominent?

Firewire opportunity, depth quick comment! Hello, everyone, I am a little god of wealth ~

This week, the real estate sector was injected with a shot in the arm, and Friday’s heavy policy release made the overall market jump from the shock adjustment in the previous four trading days, showing a remarkable rebound trend.

Real estate and related sectors, including banking, insurance, building materials and household items, have shown a strong momentum like sailing boats. Take real estate ETFs and building materials ETFs as examples. This week’s increase has exceeded 7%, and the plate effect is shocking!

So, how long can this feast of the real estate sector last? No one can predict it accurately. However, we can refer to a set of statistics released by Caitong Securities:

Since 2022, there have been four rebounds in the real estate sector. The average increase of the real estate sector index in the past four times was 18%, which lasted for 28 days, and the turnover rate at the high point was 3.2%. It is worth noting that after this week’s surge, the increase performance of this round of real estate sector has exceeded the historical average.

The real estate sector is so hot that the FireWire Quick Review Team will naturally not be absent. It has been tracking this sector in depth for three consecutive weeks, and the related stocks shared have also gained gratifying results. In addition, this week also paid special attention to the leader of the big financial sector — — Bank shares. Let’s give you a simple answer.

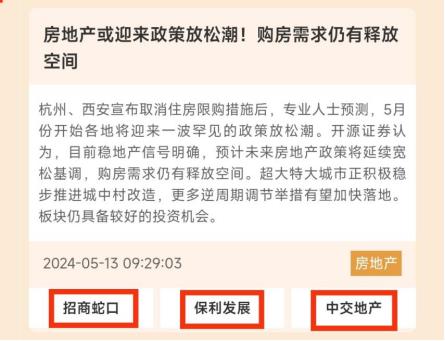

On the morning of May 9, Hangzhou officially announced the complete cancellation of the property market purchase restriction policy. Xi’ an followed closely, and also canceled the housing purchase restriction measures. Professionals predict that a rare wave of policy relaxation will begin in May.

Open source securities believes that the current signal of stable real estate is clear, and it is expected that the real estate policy will continue to be loose in the future, and there is still room for the release of housing demand. Mega-cities are actively and steadily promoting the transformation of villages in cities, and more countercyclical adjustment measures are expected to accelerate the landing. Therefore, the plate has good investment opportunities.

The FireWire Quick Review Team sorted out the investment logic and related stocks of the real estate sector for the first time, and released the information before the close of trading on May 13th. Among them, China Merchants Shekou, Poly Development and China Communications Real Estate, the highest growth rates reached 17.73%, 17.65% and 16.63% respectively within five days after the release of the information, which was quite gratifying.

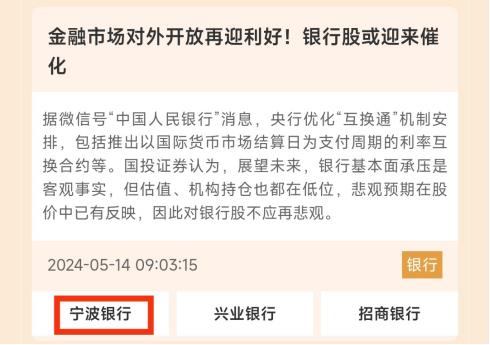

On May 13th, the central bank optimized the "swap link" mechanism, including the introduction of interest rate swap contracts with the settlement date in the international money market as the payment cycle. In addition, National Inter-bank Funding Center, Inter-bank Market Clearing House Co., Ltd. and Hong Kong OTC Clearing House Co., Ltd. will simultaneously introduce other system optimization and preferential measures to reduce the business participation cost of domestic and foreign investors.

In the past, the valuation of bank stocks was suppressed by the downturn of the real estate cycle. As the macro-economy of China continues to pick up and improve, the financial risks generally converge, and the factors that suppress the valuation are expected to be released slowly. SDIC Securities believes that looking forward to the future, it is an objective fact that the fundamentals of banks are under pressure, but the valuation and institutional positions are also at a low level, and pessimistic expectations have been reflected in the stock price, so we should not be pessimistic about bank stocks.

The firewire quick review team quickly followed the investment logic of the banking sector and related stocks, and released the information before the market closed the next day (May 14th). Among them, the highest increase of Bank of Ningbo was 6.5% within five days after the information was released.

Since the beginning of this year, the large-cap stocks represented by the big financial sector have performed very well, and the confidence of investors is constantly being repaired. The next market performance is still worth looking forward to.

There are thousands of financial events, and there are only a few valuable ones. As an investor, how to use the current favorable market to accurately capture the rhythm of market hotspots? Download the national business daily APP quickly, lock in the quick comment column of FireWire, and take you to explore the hot concepts and theme opportunities in the market.

Follow these steps to unlock a wonderful information article for free every day.

Step1: Scan the QR code below to download and install national business daily APP.

Step2: Open the APP, click "Private Customization" on the home page, and find and enter the "Firewire Quick Review" column.

Step3: In the "Quick Review of Firewire" column, select an information article that you are interested in, click the "Read Full Text" button, and then you can read the full text after confirmation.

Finally, if you have any questions about the "firewire quick review" products, please contact the little god of wealth to solve them ~

Firewire opportunity, depth quick comment! I’m a little god of wealth, and I’ll see you next week ~

(Daoda Little God of Wealth)

The content of this article is for reference only, not as a basis for investment, so you should enter the market at your own risk.

Cover image source: national business daily Liu Guomei photo